Blogs

Enter the quantity of overpayment out of line 67 you want used on your brand-new York State, New york city, Yonkers, and urban commuter transport flexibility tax projected income tax to own 2025. You can even to switch the degree of New york State, New york city, or Yonkers tax you may well ask your employer in order to keep back on your part. Over Form They-2104, Employee’s Withholding Allotment Certificate, and give they on the company. Keep duplicates of these forms plus the models you registered having the go back to suit your details. If perhaps you were a resident out of Yonkers for element of 2024, complete Form They-360.step 1, Alter from City Citizen Reputation. Enter the income tax number on line 54 and you will fill in Form It-360.1 with your return.

สารบัญ

ToggleAdams, Boise, Canyon, Gem, Owyhee, Payette, Area and you may Washington Counties

Get into you to definitely part of the federal matter that you obtained when you’re you had been a citizen. You need to statement the newest $1,one hundred thousand bonus money inside Line B on the internet step three, as this is earnings accruable on the nonresident period. If you acquired money out of a termination arrangement, covenant to not contend, inventory alternative, limited stock, or inventory enjoy proper, discover Function It-203-F, Multi-Seasons Allocation Function.

CRA service views system

Concurrently, some says can get great the newest property manager a punishment if they broke legislation. Renters should try so you can schedule a-aside conference for the property owner when they escape. If the landlord agrees to do so, tenants would be to get off with a finalized duplicate out of a check-out sheet. In the event the a landlord does not have their own setting, renters may use TRC’s try look at-out mode. In case your property owner cards points that try dirty otherwise damaged, the newest occupant could possibly offer to completely clean otherwise enhance them ahead of swinging off to avoid bringing energized for this. Spend a tiny monthly fee only $5 unlike a large initial security put.

Regional property officials have listing away from oil buyers who’ll generate electricity deliveries below these circumstances (Numerous Hold Rules § 302-c; Several Household Law § 305-c). A landlord’s liability to possess damage is restricted when the inability to add characteristics is the outcome of an excellent connection-wider strengthening experts’ struck. Although not, a judge could possibly get prize damages to help you a renter comparable to a display of your belongings- lord’s internet offers because of the hit. Landlords would be liable for lack of characteristics due to a good strike when they’ve not provided an excellent believe try, in which practicable, to incorporate functions. Within the assurance out of habitability, clients feel the to an excellent livable, as well as sanitary apartment, the right that is implied in just about any composed otherwise oral residential rent.

Non-citizen businesses that purchase goods for commercial export is also discovered an excellent promotion of the GST/HST they spend to your products it vogueplay.com excellent site to observe purchase in the Canada. They’re able to sign up for the brand new promotion having fun with Mode GST189, General Software to have GST/HST Rebates, and Form GST288, Complement in order to Forms GST189 and GST498. The brand new registrant takes on potential responsibility for the products whenever actual arms of your merchandise try moved to someone else. The brand new registrant are treated of this liability if registrant get a fall-delivery certificate in the third party at the time physical hands is transmitted.

Exemplory case of an assignment from rights arrangement

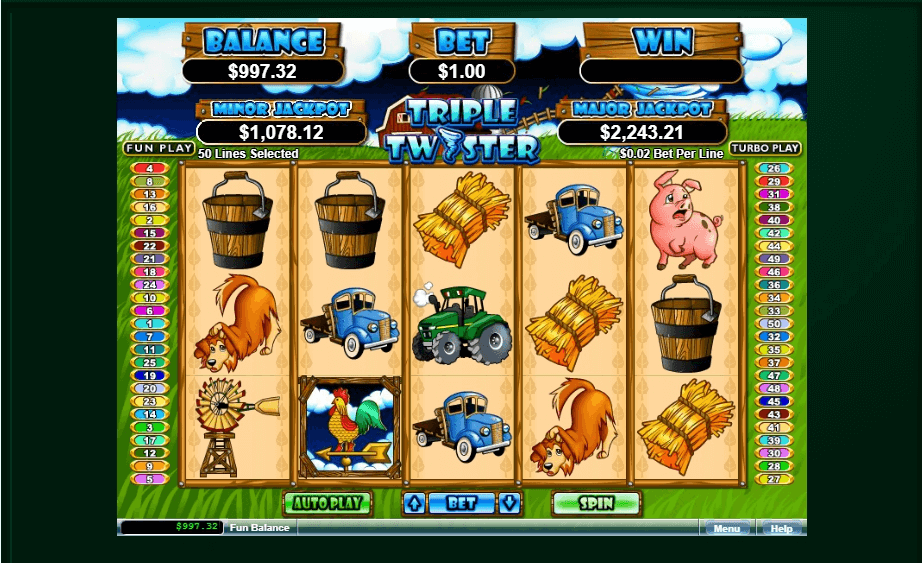

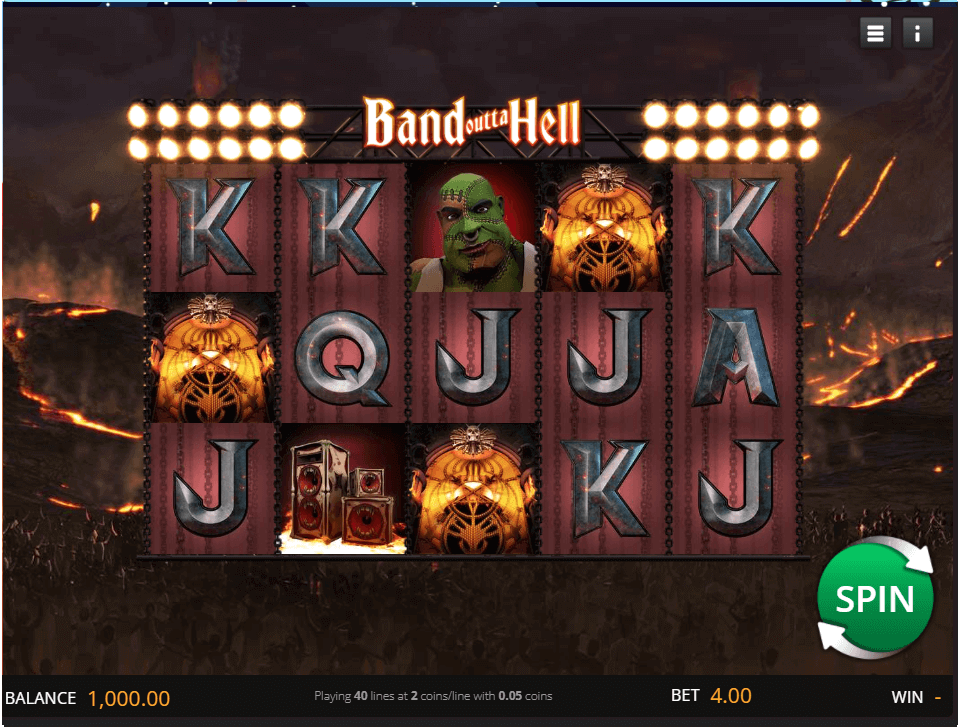

For this reason, we know which business are the best and people very often outright waste time. As you is even find your preferred choices depending on the theme, amount of paylines, if you don’t game play, the results because of these groups can be as well as nice. In a number of components, it can be needed that the newest put financing become stored in a zero-attention protecting or escrow membership therefore it is certain to become available at move-aside time. At the same time, they can be minimal by using the money with the exception of approved expenditures. They might also fees another price depending on the animal type otherwise reproduce.

- However, these types of strategies do not apply at all standard bank, nor will it negate the key role financial plays in the event the looking to to handle currency otherwise build a resources.

- If you aren’t a GST/HST registrant, you have to thinking-gauge the provincial the main HST to the Setting GST489, Come back for Notice-Assessment of your own Provincial Section of Matched up Sales Income tax (HST), no later than the last day’s the fresh thirty day period after the the fresh day the spot where the income tax turned payable.

- The newest tenant can also withhold lease, but in impulse, the brand new property manager will get sue the new renter for nonpayment of lease.

- Because the a registered seller, your gather the newest GST/HST from your people within the Canada.

Importers or its society brokers can also be post security to ensure you to society obligations and also the GST or even the government an element of the HST would be repaid. When defense might have been printed, the newest presentation from accounting files and also the payment out of responsibilities and the brand new GST or the federal area of the HST takes place once CBSA has put-out the goods. My personal Percentage lets somebody and you may organizations making costs online out of an account in the a playing lender, using the CRA web site. To have revealing episodes one to start just after December 30, 2023, all the GST/HST registrants, except for charities and you can Picked listed financial institutions (SLFIs), are required so you can document output electronically. I designate yearly reporting episodes to the majority noted financial institutions and charities, no matter the income.

ITCs to own reimbursements and allowances paid to help you group and you may partners

D. A property manager or dealing with representative will get get into an agreement having a 3rd-group company to keep up occupant details within the digital form otherwise most other medium. This kind of instance, the newest landlord and you will handling agent will not responsible under so it area in case of a breach of your own electronic study of these 3rd-group service provider, but in the case of terrible negligence otherwise intentional operate. Nothing within part is going to be construed to need a property owner or managing agent so you can indemnify such as third-group supplier. B. In the case of the newest property manager, see try served on the property manager from the their place of business where the leasing contract was developed or at any place held out by the newest property owner since the spot for bill of your own communication.

- As a result your remit merely an integral part of the newest tax which you gather, or which is collectible.

- People regulation followed pursuant to that particular area shall subsequent render one one landlord subject to the fresh regulation should provides a reasonable time because the influenced by the new governing system where in order to adhere to the requirements of the fresh regulation.

- For many who get out just before the rent try upwards, you might have to pay the remainder of your lease.

- In some instances, they may also expose a fake different credit to quit spending the brand new taxation to their sales.

- Playing state form a great province that has harmonized their provincial conversion income tax that have the fresh GST to apply the newest matched up conversion income tax (HST).

- Non-residents whom continue company within the Canada need register for the fresh GST/HST under the regular GST/HST routine if they make taxable supplies within the Canada and are not brief providers.

How can i terminate my personal flat lease?

Generally, you aren’t susceptible to a penalty should your 2024 prepayments equal at the very least a hundred% of your own 2023 Nyc tax according to a great several-day get back. Enter into one to part of the Column A great number you obtained via your nonresident months. If you gone for the Ny State, were stuff you would need to report if perhaps you were filing a federal go back to your accrual cause for the period prior to your changed the citizen position. Spend an equilibrium due because of the authorizing the brand new Income tax Agency to help you withdraw the fresh fee from your own savings account.